German energy giant E.ON apparently lobbied cabinet ministers for stiff sentences against Kingsnorth activists, according to papers released under a FOIA style request made by Greenpeace. The company suggested that without “dissuasive” sentences, they might be less willing to invest in generation facilities in the UK in the future. Light sentences for non-violent direct action, and no more coal investment? Sounds like a win-win to me.

Tag: coal

ALEC attacking renewable energy standards nationwide

The American Legislative Exchange Council (ALEC) is at it again, trying to roll back state renewable energy standards nationwide. The argument behind their model bill, entitled the Electricity Freedom Act, is that renewable energy is simply too expensive. The Skeptical Science blog offers a good short debunking of this claim, based on the cost of electricity in states with aggressive renewable energy goals, and how those costs have changed over the last decade. And this is before any social cost of carbon or other more traditional pollutants is incorporated into the price of fossil fuel based electricity.

Their summary:

- States with a larger proportion of renewable electricity generation do not have detectably higher electric rates.

- Deploying renewable energy sources has not caused electricity prices to increase in those states any faster than in states which continue to rely on fossil fuels.

- Although renewable sources receive larger direct government subsidies per unit of electricity generation, fossil fuels receive larger net subsidies, and have received far higher total historical subsidies.

- When including indirect subsidies such as the social cost of carbon via climate change, fossil fuels are far more heavily subsidized than renewable energy.

- Therefore, transitioning to renewable energy sources, including with renewable electricity standards, has not caused significant electricity rate increases, and overall will likely save money as compared to continuing to rely on fossil fuels, particularly expensive coal.

But really, go read the entire post for more detail.

NRDC plan to cap GHG emissions from power sector using the Clean Air Act.

The NRDC has a plan that would allow the EPA to regulate GHG emissions from existing power plants, without either capitulating to the power sector, or banning coal outright immediately (which would be politically… uh, difficult). The trick is to use fleet-based target, as we do with vehicle emissions standards. The natural (regulatory) unit is the state, so each state could have its own carbon intensity targets or degression pathway, tailored to its initial generation mix. The carbon intensity would decline over time, eventually squeezing coal out of the mix, and could allow energy efficiency improvements to count toward the goal, at least initially. It really amounts to a kind of back-door cap-and-trade for the power sector, and it can be implemented by Obama, all on his lonesome, without any help from the intransigent congress. The hard part here will be setting stringent enough long term targets. 40% reduction by 2025? 90% reduction by 2050?

Doing the Math on Climate Divestment

I just got back from the 350.org Do The Math event in Boulder. The touring show is an outgrowth of Bill McKibben’s piece in Rolling Stone this summer, Global Warming’s Terrifying New Math. The argument is elegant and horrifying: if we want to keep global temperature from rising more than 2°C, we can emit at most 565 more gigatons of CO2, ever. Currently, the global fossil fuel industry’s reserves total nearly 2800 gigatons. That carbon accounts for a substantial fraction of their overall market value, and at least 80% of it must never be extracted. Ergo, we must necessarily bankrupt pretty much all of them, and soon. At our present burn rate, we’ll have used up the 565 Gt allowance in about 15 years, taking us well into that part of the map where, as they say, there be dragons.

I get all of the above, and am enthusiastically in support. However, I’m confused by the logic of McKibben’s suggested first salvo against the industry. He is promoting a divestment campaign, along the lines of the one aimed at apartheid South Africa in the 1980s. In this campaign, institutional investors susceptible to moral or public relations arguments — like pension funds, church congregations and university endowments — are being encouraged to purge their portfolios of fossil fuel related securities. There seems to be widespread confusion as to what this would mean in a purely financial sense to the targeted companies. Certainly the audience was confused, but I couldn’t tell what McKibben and the other folks on stage really thought.

So, what would happen if a major swath of the world’s institutional investors dumped their fossil fuel stocks? Presumably, this would depress the industry’s stock prices, by reducing demand. But would this actually hurt the companies in any way? The simple answer is no. Most people I talked to seemed to think that by selling stock, they’d somehow be taking money away from these companies. That’s just not how stock works. The only time you’re buying stock from the company itself, and giving it funding, is at the initial public offering (IPO), or, occasionally, in subsequent public financing rounds, where new shares are issued, diluting existing shares. Institutional investors owning shares of publicly traded companies are trading with other investors, not the company itself. You can’t go to a company and say “I want my money back” after they’ve issued the stock. Sometimes companies that are sitting on a mountain of cash will voluntarily buy back their own stock, but this results in the value of remaining outstanding shares appreciating — you’re sharing ownership of the same business over fewer shareholders. Buybacks are often used as a tax efficient way to return earnings to investors, since dividends are taxed as income, but share price appreciation is taxed as capital gains, and those taxes can be deferred indefinitely.

The stock price of a company that’s in financial trouble goes down, reflecting that financial trouble. Artificially depressing that company’s stock price doesn’t induce financial trouble. What would it do? It would lower the price to earnings (P/E) ratio, which would increase the dividend rate. It would make the companies with stable underlying businesses more attractive stock purchases, and in a purely financial world, other less morally encumbered investors would buy up all the dumped shares, probably severely limiting any depression of the stock price.

The fact that climate divestment won’t starve the fossil fuels industry of capital doesn’t necessarily make it a bad idea. So what are the other potential consequences of a successful divestment campaign?

Getting churches, universities, pension funds and other institutional investors to divest would decouple their financial interests from those of the fossil fuels industry. This might make it easier for divested institutions to take strong political stances on climate change. At the same time, as an individual, unless you have a lot of money invested, or live in a very efficient house and refuse to drive and fly, you’re more tightly bound to the financial interests of these companies via the prices of the fossil fuels you consume, than by the prices of the stocks of the companies that produce them.

If you’re feeling optimistic, getting institutions you care about (or depend on) to divest from the carbon industry might be seen as self-interested. If we succeed in keeping 80% of the world’s booked fossil fuel reserves in the ground, then all these companies are the walking dead. Like the hordes of zombie banks created in the financial collapse a few years ago, in a world that rises to meet the climate challenge, they are already bankrupt — they just don’t know it yet. If you really believe we’re going to succeed, divesting is clearly the right thing to do financially in the medium to long run.

Probably most importantly, the campaign is aimed at branding fossil fuels as a morally repugnant investment, both explicitly and by analogy with the apartheid divestment movement. In the case of South Africa, it was successfully argued that companies taking advantage of apartheid were benefiting from a form of legalized slavery, and anybody sharing in those profits was, in some part, morally equivalent to a slaveholder. In the case of the Carbon Lobby we’re not slaveholders, we’re waging a war on the future. This is particularly ironic in the case of university endowments, which support the education of young people, who will live further into that war-torn future than the rest of us, and pension funds that ostensibly work to ensure we are supported in our old age, as much as 50 years hence.

Morally repugnant industries are often allowed to operate, but their political influence becomes diminished and expensive. Unless you’re actually representing a tobacco growing district, it’s tough to stand up publicly these days as a politician and rub shoulders with tobacco companies. Their veneer of respectability has been peeled away. This has made advertizing restrictions and smoking bans and hefty sin taxes politically possible. If fossil fuel extraction were broadly accepted as a repugnant transaction, would it remain politically feasible to continue spending five times as much on fossil fuel subsidies as we do on climate mitigation?

In the case of the technology driven oil and gas development and exploration, one might hope that a successful re-branding of the carbon industries as repugnant dinosaurs waging a war on the future would make it more difficult for these companies to recruit young technologically savvy talent, at any price. Will petroleum and coal mining engineers one day feel unable to mention their work, for fear of public shaming?

This shift in our cultural norms about whether releasing geologically sequestered carbon is morally defensible is necessary, I think, but like virtually all climate campaigns it is not alone sufficient. Especially in the energy-intensive developed economies, shaming and shunning the fossil fuel industry must also involve some amount of self-flagellation today. It runs the risk of guilt-tripping people whenever they buy gas or fly, or leave the coal-fired lights on in the kitchen overnight. That guilt can induce people to tune out, if they don’t feel like they have any alternative to their “bad” behavior.

We need to aggressively create those alternatives by creating paths to high-renewable penetration electricity, building cities for people that don’t depend on cars, inter-city high-speed rail that doesn’t suck, re-solarizing our agricultural systems, requiring the highest possible building energy efficiency, and mandating closed-loop zero-waste materials systems whenever they’re possible. We also need to make sure we brand the fossil fuel industry as other. We need a Them. They take hundreds of billions of dollars in subsidies every year. They fund disinformation campaigns on climate. They spend half a million dollars a day lobbying congress. They are the problem, preventing necessary change, preventing us from adopting systems that don’t wage war on the future. This otherness can forestall that feeling of short-term guilt.

This may sound like irresponsible heresy in the face of a tidal wave of consumer green marketing. However, the vast majority of our emissions and resource utilization are systemically determined, and are not susceptible to significant change through personal choices alone. Those necessary systemic changes are being blocked in large part by industry lobbying and disinformation. In that arena of systemic change, which is what matters most, it really is Us vs. Them.

Ripe for Retirement: The Case for Closing America’s Costliest Coal Plants

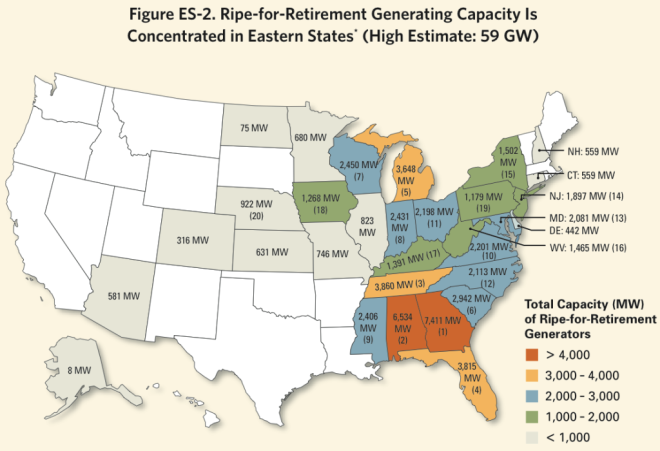

The Union of Concerned Scientists has gone through the catalog of America’s coal plants, and found hundreds of mostly small, old, polluting, inefficient generating units that just aren’t worth operating any more, even on a purely economic basis. They looked at several different sets of assumptions, including different natural gas prices going forward, a price on carbon, whether or not the competing natural gas fired generation would need to built new, or whether it existed already with its capital costs paid off, and whether or not the production tax credit for wind ends up being renewed. In all of the scenarios considered, they found substantial coal fired generation that should be shut down on purely economic grounds, above and beyond the 288 generating units that are already slated for retirement in the next few years. They also found that some companies — especially those in traditionally regulated monopoly utility markets in the Southeast — are particularly reluctant to retire uneconomic plants, and suggest this may be because they can effectively pass on their costs to ratepayers, who remain none the wiser.

Ripe For Retirement: The Case for Closing America’s Costliest Coal Plants

The Union of Concerned Scientists has gone through the catalog of America’s coal plants, and found hundreds of mostly small, old, polluting, inefficient generating units that just aren’t worth operating any more, even on a purely economic basis. They looked at several different sets of assumptions, including different natural gas prices going forward, a price on carbon, whether or not the competing natural gas fired generation would need to built new, or whether it existed already with its capital costs paid off, and whether or not the production tax credit for wind ends up being renewed. In all of the scenarios considered, they found substantial coal fired generation that should be shut down on purely economic grounds, above and beyond the 288 generating units that are already slated for retirement in the next few years. They also found that some companies — especially those in traditionally regulated monopoly utility markets in the Southeast — are particularly reluctant to retire uneconomic plants, perhaps because they can effectively pass on their costs to ratepayers, who remain none the wiser.

Cost Effectiveness of Renewable Energy in Michigan

In the 2011 annual report to the state legislature on the cost effectiveness of Michigan’s Renewable Energy standard, it was revealed that wind bids have been coming in far cheaper than anyone expected they would. In fact, even without the federal production tax credits, they’re far cheaper than new coal fired generation ($61/MWh for wind vs. $107-133/MWh for new coal). Interestingly, Xcel’s 2011 resource plan lists the cheapest new generation option in Colorado as being natural gas combustion turbines… at $60/MWh. So wind is cheap. It’s also very low risk. So how do we get more of it?

Sustainable Energy Without the Hot Air by David MacKay

What does a world without fossil fuels look like? There are lots of different options, but none of them look much like the rich developed nations of the world today. David MacKay’s approach in Sustainable Energy Without the Hot Air is to hold our rate of energy consumption constant, and explore the kinds of carbon-free energy systems that could satisfy that demand. The uncomfortable conclusion he comes to is that if we want to run our world on renewables, the energy farms have to be comparable in scale to nations. Comparable in scale to our agricultural systems. This is because all renewable energy is very diffuse, and we use a whole lot of energy.

Just as an example, of all the renewable power sources solar is the most concentrated, and PV farms like the ones cropping up in Bavaria because of Germany’s generous feed-in tariff average about 5W/m2. With better siting (the Sahara, Arizona) you can do a bit better, and there’s a little more efficiency to be eked out of the panels, but for large scale deployments, you’re not going to get above 10W/m2. If you’re an average citizen of the EU or Japan, your 5kW of power thus demands 500m2 of land. Multiply that by 700 million people in the EU, and you get the total area of Germany. An average North American’s 10kW requires 1000m2. Multiply that by 300 million people, and you get an the entire area of Arizona.

Continue reading Sustainable Energy Without the Hot Air by David MacKay

Arizona Public Service Diversifies Generation Sources | Renewable Energy Project Finance

Arizona has decided to include externalized costs like water use and pollution in their utility resource planning process, with the predictable result that they’ve selected a resource portfolio heavy on renewables and energy efficiency, and light on coal. Hopefully other states will follow their lead!

Global Warming’s Terrifying New Math

Bill McKibben looks at Global Warming’s Terrifying New Math via three numbers. The problem at hand: if we want to limit warming to 2°C, we can only (globally) put about 565 more gigatons of CO2 into the atmosphere. Unfortunately the fossil fuel industry already has about 2800 gigatons worth of reserves on their balance sheets. If we are to avoid profound alteration of the climate, all those reserves will have to be written off and taken as a loss. This will, of course, bankrupt the entire industry. That’s the goal. It’s them, or the atmosphere.