It’s often been said that “time is money,” and it turns out to be more than an aphorism.

I’m going to try and tell you a story about discounting, which is one of the ways that we convert between time and money. The story has broad implications for the energy investments we choose. It’s not entirely straightforward, and if it’s going to make sense there are some background pieces you’re going to need. The background is important because the ending depends not only on understanding what is being done, but why. This story happens to be about Xcel Energy and Colorado, but the same thing happens in other places, with other companies, and in other contexts too.

To greens my argument may seem circumspect. I’m not going to challenge the doctrine of Everlasting Economic Growth. I’m not going to look at the large externalized costs of burning fossil fuels. I’m not going to argue against the monopoly electrical utility model. Those are important discussions to have — they’re just not the one I’m having here. What I’m trying to do is show that a minor change in the way we calculate the cost of future energy can drastically alter what kind of power we decide to invest in for the next century, even if we only look at the decision in selfish financial terms.

To the finance geeks among you, much of the background will be familiar, but the situation may seem strange unless you’re familiar with how regulated monopolies work. I haven’t been able to find anyone familiar with energy finance who thinks what we’re currently doing makes sense, but if you’ve got a thoughtful rebuttal, I’m genuinely interested to hear it.

What is a discount rate?

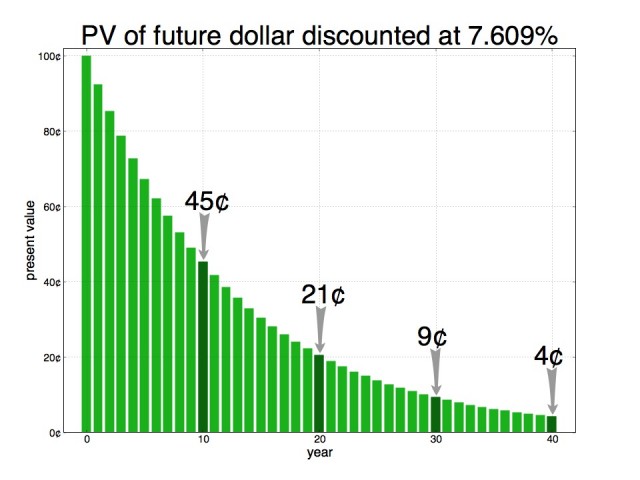

Let’s say I’m going to give you $100, but I offer you a choice. Would you rather I paid you now, or a year from now? Most people (especially corporate persons) would rather have the $100 today. But what if I offered you a slightly different choice. Say you can have the $100 today, or $110 next year. Then it becomes a more difficult judgement call. If you turn that down, maybe $120 next year would change your mind? For nearly everyone there’s some additional amount that is enough to justify delaying your gratification. How much extra it takes indicates your discount rate. The larger your discount rate is, the more you prefer your rewards in the present, rather than the future. If you’re indifferent as to whether you get the money now or later when it’s $100 now vs. $110 in a year, then your discount rate is 10%. Putting it slightly differently, if your discount rate is 10% then $100 is the present value (PV) of $110 received one year from now.

This idea of present value confuses a lot of people. We’re used to thinking of money moving forward in time, not backward. When you carry money into the future, it gets bigger. If you invest money today then in the future at some point you hope you’ll have more money, because you earned a return on your investment. If you borrow money today and re-pay it over time in the future, you’ll repay more than you borrowed, because you have to pay interest. In exactly the same way if you move money backward in time it gets smaller. In the above example of a 10% discount rate, the present value of $110 one year from now is $100. That’s how much a guarantee of $110 one year from now is worth today given the 10% discount rate. In calculating the present value, both the dollar amount ($110) and the time of payment (1 year from now) are important. For every additional year out into the future we go, we have to apply the discount rate again, so at 10% $100 today is worth $110 ($100 x (1+10%)) one year from now. Two years from now that $100 is worth $121 ($110 x (1+10%)). And on and on into the future. This short Khan Academy video does a great job of getting the idea across:

If you’ve got 10-40 minutes, and want more detail, check out their other videos on present value and discounting: parts one, two, three, and four.

Why do we use discount rates?

Calculating present and future values is not difficult math once you understand the concepts, and most spreadsheet programs have built-in financial functions that will do the work for you, as long as you know what numbers to put into them. However, to understand the point I’m trying to make, it’s important to understand the why behind discounting.

Discount rates, interest on loans, and expected investment returns are all in the same family. They’re expressions of the same underlying time value of money in different contexts. Most people have an intuitive preference for money now rather than later, but discounting and financing make rational sense too. If you’re getting the financing — taking out a mortgage to buy a house — you’re willing to pay more overall for the privilege of paying later. If you’re offering the financing, then you demand a return in exchange for giving up access to your money for a while — there’s an opportunity cost for not doing so, since if your money wasn’t tied up with this investment, you could put it in another one. Financing is the business of converting between lump sums and cashflows, redistributing money throughout time. Some people have a pile of cash, and they’re willing to let you use it now, so long as you build them a bigger pile of cash later. The rate of return, interest rate, or discount rate is the price of this service. That price is generally set by the markets, based on what kinds of investment opportunities are available with a given level of risk. As long as there are investment returns to be made, money that you don’t get until the future will be worth less than money you can have in the present, and so that future money will need to be discounted if you want to compare it directly to present money.

Sometimes this kind of discounting due to investment opportunity cost gets confused with inflation. Mathematically inflation does very similar things to future money — it makes the same number of dollars worth less — but that’s because those inflated dollars really do have less purchasing power, not because you have to wait until later to get them.

How do we use discount rates?

Discounted cashflows show up in lots of places, but one of their most common applications is in evaluating the relative attractiveness of competing investments. Often this is done using net present value (NPV). The NPV of an investment takes into account how much money you have to invest, when you have to invest it, how much money you get back and when you get it back. In the same way that the present value, above, tells you how much some particular pile of money at some particular time in the future is worth today, the NPV tells you how much a series of net cash flows is worth in the present. Usually the first year (or few years) will be negative, while you’re laying out the initial investment. Subsequent years will hopefully be positive, as your investment starts paying off. The NPV adds up all those years of costs or revenues, discounting each year appropriately for how far in the future it is, and gives you a lump sum equivalent. Again, the Khan Academy videos referenced above do a good job of explaining this process, so if it’s not clear, I recommend watching them.

Looking at the NPV of two different investments — say building a gas fired power plant vs. a wind farm — tells you which is the better deal. The wind farm will have a larger up-front cost, but lower operating and maintenance (O&M) costs over its lifetime, and thus a larger profit margin per kWh of electricity produced if you just look at the O&M. The gas plant is cheaper to build, but you have to pay for fuel as you go, and so the profit margin (again, looking just at the O&M) is likely to be lower.

Just as an example, say your wind farm cost $1B up front, and you net $100M in profits from it each year for 40 years. $100M/yr for 40 years is a total of $4B, minus the initial $1B investment, and that’s a net of $3 billion. But if we discount the cashflow series at Xcel’s 7.609% rate, then we find its NPV is only $244M.

Say the gas plant costs $250 million up front, but because of fuel costs, only nets you $50 million a year, and also lasts for 40 years. 40 years at $50 million/year is $2 billion. Subtract the initial investment of $250 million, and the gas plant should be worth a total of $1.75 billion, right? But discounting at 7.609% we see that the gas power investment has a NPV of $372 million.

Note that discounting didn’t just reduce the apparent values of these investments ($3B became $244M and $1.75B became $372M); it also changed which one appears to be worth more. The overall effect of discounting is to diminish the importance of future money relative to present money. This makes it difficult for an investment with a high up front cost to be profitable, even if it also pays high dividends for a very long time. The distant future profits just don’t show up in the present valuation. Discounting makes it generally preferable to minimize up front expenses, accept higher O&M costs, and adopt a pay-as-you-go attitude. Unfortunately for our greenhouse gas emissions, this means we’ve historically been biased against capital-intensive renewable energy and in favor of O&M-intensive fossil fuels.

CapEx vs. pass-through and the RRM

Now, it turns out that it doesn’t quite make sense for Xcel to use NPV to choose between different generation options. This is because Xcel is a monopoly. Their fuel, construction and other costs are set by the markets, but their revenues — the money they collect from their customers — are not. Instead, they’re allowed by the Public Utilities Commission (PUC) to charge us as much as is required to ensure that they recover their costs and make a “reasonable profit” on their capital investments. In effect, their revenues — the positive portion of their future cashflows — are guaranteed. The O&M portion will cancel out their costs exactly, and the capital expenses portion has a fixed, built-in rate of return. That rate of return is the 7.609% I referenced above, also known as their weighted average cost of capital (WACC). It’s just the average rate they have to pay on money they raise, either by issuing debt (taking out a loan from investors) or issuing stock (shares of ownership in the company).

So instead of NPV, they use something called the revenue requirement method (RRM). Whereas NPV looks at the net cashflow for each year of the project’s life — the sum of income and expenses — RRM looks only at expenses. Given the expenses associated with a particular resource plan, Xcel then calculates how much we’d have to pay year by year over the lifetime of the project for them to cover their costs and make their profit.

It’s key to note that this mark-up, this profit margin, only applies to capital expenses (CapEx) like new power plants. It does not apply to operating and maintenance costs like fuel. Instead, Xcel passes all the O&M costs, including fuel, through directly to its customers. You can see it as a line item on your bill each month. It’s labeled ECA: energy cost adjustment. This means that if fuel costs are higher than expected it doesn’t eat into Xcel’s profits and if they’re lower than expected they don’t get to keep the difference. These details have some interesting consequences.

First, Xcel is strongly incentivized to build capital infrastructure; it’s the only place they can make money. The monopoly utility business is all about maintaining a robust capital investment pipeline — a steady stream of big projects you can spend billions of dollars on — because that’s the only place you make a profit, and those profits are close to being guaranteed.

Second, Xcel has no skin in the game when it comes to fuel prices. They hire some consultants to come up with fuel price estimates for the next 40 years and submit them to the PUC as a best guess, but if they turn out to be wrong — as just about everyone who predicts future prices does — they can’t be hurt by it. Instead the customer base is on the hook for the fuel costs, whatever they might turn out to be.

Together, all these regulatory details — that future fuel costs become small when they are present valued, that the customers are responsible for paying the fuel costs no matter what, and that the only profits the company can make are on capital investments — mean that Xcel is probably willing to think long and hard about how they can justify large capital investments, regardless of the potential fuel cost consequences.

There are some problems with this arrangement from the rate-payer’s point of view.

My risk, your fuel

The first problem is that the risk of future fuel prices being higher than expected is not monetized.

In many commodity intensive businesses, it’s common for companies to hedge against increases in the prices of the commodities they depend on — to lock in a predictable price that they know they can live with, even if it’s higher than the current price, so that they don’t have to worry about unexpected cost overruns bankrupting them. Southwest Airlines famously made bank in the 2000s because they were well hedged against the possibility of fuel price increases, and fuel prices did increase, much more than anyone predicted. That was a windfall, and as fuel prices came down after the 2008 peak, the airline’s hedging strategy looked less savvy, but that misunderstands the true point of hedging — it’s not a bet on prices going one way or another, it’s a way to reduce your exposure to price volatility. That reduction in volatility is valuable to many businesses, because it lets them plan around a known cost, and even if that cost is a bit higher, it can be worthwhile because it enhances the stability of the business. It’s risk management.

The market value of that risk management is reflected in the prices of commodity futures contracts. Independent power producers who sell into the wholesale electricity market under contract, and who are on the hook for their own fuel costs, have a big incentive to keep those costs under control. If they promise to provide some number of peaking megawatts on demand at some price point, and then gas prices quadruple, they still have to provide the power, even if it’s not profitable to do so given what they agreed to get paid. If you’re responsible for paying for the fuel, it’s often worthwhile to pay extra to avoid potentially extreme future price volatility.

When Xcel goes to the PUC with its menu of possible resource plans, their coal cost estimates do not account for potential price volatility at all. For natural gas, they do incorporate the cost of hedging based on 10 year NYMEX gas futures contracts (it’s something like $0.90 per million BTUs, on top of the current gas price of around $2.50, in the resource plan it’s called the Gas Price Volatility Mitigation or GPVM adder), but the generation resources that we’re talking about adding will be around much more than 10 years, and they are being compared directly against renewable generation resources that have very stable costs — they may require a big up front investment, but you know how much that power is going to cost you 30 years down the road. High up front costs and low price volatility are related, it’s not a coincidence that they come together. You know how much renewables are going to cost because you do most of the spending before you get any of the electricity. So with renewables there’s a built in price hedge. If you want to compare renewable energy with fuel-based power on equal footing, you need to also include the cost of hedging away future fuel price volatility for your gas or coal fired power plant on a timescale that’s comparable to the lifetime of the (naturally hedged) renewable power sources. I’m no futures trader, but I’m pretty sure that locking in a 40 year fuel supply contract at a fixed price is significantly more expensive than doing it for 10 years.

Fossil fuel proponents will want to point out here that there are additional system costs associated with integrating intermittent renewables — and they’re right — but those costs are already being counted against renewables in the alternative resource plans that Xcel has modeled.

My investment, your discount rate.

The second — and larger — problem is that future fuel costs are being present-valued using Xcel’s discount rate of 7.609%, even though Xcel’s investors are not financing the fuel purchases. It is we as utility customers who ultimately guarantee those future fuel payments no matter what they end up being, so the discount rate that ought to be applied to them is completely divorced from Xcel’s cost of capital. In addition, the rationale for discounting future O&M expenses is fundamentally different from the rationale for discounting Xcel’s capital expenses, which must be financed up front.

When there’s financing involved — when someone is providing capital up front and demanding a return on their investment — discounting makes sense because of the opportunity cost of dedicating money to any particular investment (and thus not to other possible investments). With O&M costs like fuel, there are no investors giving up access to their capital in order to allow us to buy the coal and natural gas. The fuels are bought and paid for almost simultaneously, as we use them, over decades. (Of course, we could finance all our future fuel — buy it up now and store it somewhere — and that would take care of the future fuel price risk, but it would be very expensive, since we’d have to pay interest on the loan we’d need to buy all the fuel up front. If Xcel did this, then using their 7.609% WACC to discount future fuel would be totally justified. But they don’t do this.)

If there’s no reason to use Xcel’s cost of capital, then what is the right discount rate for future fuel expenses? It’s the public (Xcel’s customer base) who is on the hook for the fuel costs, so it’s the public’s discount rate that applies. However — and this is important — it’s not our investment opportunity cost discount rate. That’s because we aren’t choosing between putting away money now to pay our future utility bills, and investing it in our 401(k) plans to live off of in retirement. We don’t have to give up access to the money now at all, because we won’t have to pay for the fuel until we’ve actually used it, in the future. It will be paid out of our income streams then.

Because there’s no opportunity cost involved, the right discount rate is the one that reflects the public’s intrinsic time preference, i.e. how much we value the present over the future. We need to set that discount rate as an explicit matter of public policy, instead of just be using a number — like Xcel’s cost of capital — that happens to be lying around on the table nearby.

There’s a wide ranging debate going on about this issue in the context of climate change economics. On one side sits Lord Nicholas Stern of the Stern Review, arguing that a time preference that’s much more than zero is unethical and would indicate that we do not much care about the fate of our children or grandchildren, a position that most people would be reluctant to take. On the other side of the debate sits William Nordhaus of Yale, who argues for a time preference of something like 3% which is equivalent to saying to be worthwhile an investment of $1 today must prevent more than $2 worth of environmental degradation 25 years from now.

Personally, I tend toward Lord Stern’s position. When it comes to making deep time commitments on behalf of future generations, I believe it is unethical to treat them as less worthy than ourselves — especially when the problem to be avoided is not one you can necessarily buy your way out of. The monetary value of a habitable planet is in my mind practically infinite. But rather than try to make a detailed case that zero is the right number, I think it’s more interesting and less contentious to simply explore the range of possible discount rates, and see how different choices might affect our energy investment decisions. If it turns out that we would choose a renewables heavy portfolio even when using Nordhaus’ time preference of 3%, then we don’t need to resolve their debate to make our decision.

Why are we talking about this now?

Every four years, Xcel (via its subsidiary Public Service Company of Colorado, aka PSCo) presents a long term plan to the PUC, proposing how to keep the lights on for the next 30-40 years. The PUC and other interested parties including major energy users, environmental groups, independent power producers that compete with Xcel or sell to them in the wholesale market, ratepayer groups, etc., engage in a quasi-judicial review of the plan, requesting changes, objecting to this or that provision, and generally representing their own interests in the regulatory process.

Xcel knows that there are some people who want to see more renewable energy brought online, and so within their proposal they’ve worked up a variety of different possible generation mixes, in addition to their so-called baseline “least cost” option, which in the short term depends primarily on new natural gas fired generation (and in the long term on an as-of-yet unspecified but apparently expensive form of “CO2-free baseload”). The renewable generation alternatives are presented as premium services, costing more than the baseline. As you will have guessed by now, whether or not the gas turbines are the cheaper option depends crucially on how we discount future fuel costs.

The alternative resource plans fall into two categories, based on how much renewable power they integrate. Plans A2-A5 add 200-275 MW, while B2-B5 bring in 800-1025 MW. For a sense of scale, Xcel’s Colorado generation fleet is about 8 GW today, and they see it growing to maybe 9.5 GW by 2050, so these alternatives are playing with renewables at the 2-10% level — not particularly deep market penetration. Applying Xcel’s 7.609% discount rate to future fuel costs, the A-level plans cost $100M-$300M more than the baseline plan. The more aggressive B-level plans are anywhere from $400M to $900M extra. Now, those probably sound like big numbers, but you’ve got to look at them in the context of the overall plan. The “least cost” alternative commits us to spending an estimated $59 billion on gas and coal over the next 40 years.

All of the options with more renewable power use less fuel than the least cost option, but in order to be attractive financially, the present value of the future fuel savings associated with the renewable power has to be greater than the cost of building the wind or solar resources. At high discount rates those future fuel savings aren’t worth very much in the present, but at lower discount rates they are. Climax Molybdenum obtained the details of the costs associated with each of Xcel’s alternative plans in legal discovery associated with the 2011 electric resource planning docket (CPUC 11A-869E). I used that information to explore how changing the fuel discount rate alters the apparent costs associated with the different options. The data and calculations can be found in this Google Docs spreadsheet, and this chart gives a nice summary of the results:

On the far right, we have the costs as they appear using Xcel’s discount rate of 7.609%. There, adding a gigawatt of wind and solar costs at least half a billion dollars extra over the natural gas fired baseline plan (in terms of the present value of future costs). On the far left, the “marginal costs” of the renewables-heavy options are very negative — they’re cheaper than the baseline natural gas fired plan by a couple of billion dollars. If you’re Lord Stern, and you want a net-zero discounting of future costs, then you want to discount fuel at the monetary inflation rate or thereabouts, something like 2%, in which case the gigawatt of renewables is more than a billion dollars cheaper than the gas option. Even if you’re William Nordhaus, and you want to use a pure time preference of 3% on top of that 2% inflation, then you’re center-right at 5%, and adding a gigawatt of wind and solar still nets us more than $100M in present value.

Keep in mind that the only variable I’ve changed in these cost calculations is the fuel discount rate. I have not altered Xcel’s fuel price projections. I’m using Xcel’s cost estimates for the renewables. And these fuel costs still do not account for the first problem I mentioned above, that we are not effectively monetizing (hedging against) the risk of future fuel price fluctuations. If we did so, then future fuel having a price comparable in predictability to renewables would be more expensive than it is in these scenarios, increasing the value of future fuel savings, and making the renewable options less costly even at higher fuel discount rates. Furthermore, the costs per watt installed for wind and solar PV continue to fall.

A little saves a little, but a lot saves a lot.

Now, the really exciting thing about the above chart isn’t the fact that even with a 5% fuel discount rate we can save $131M if we go with alternative resource plan B2. The really exciting thing is that when we use an appropriate fuel discount rate, the more renewables we add the more money we save!

The above alternative resource plans were not designed to be optimal. The assumption underlying their construction was that more renewable power would necessarily be more expensive, and so of course nobody at Xcel saw any reason to include a scenario with 2GW of wind and solar. Or 3GW. Or 5GW. Or more. Without having access to some fairly sophisticated grid modeling software, it’s not easy to understand the system costs that would be associated with bringing very high renewable fractions online, so I can’t say what the most cost-effective amount of renewable power would be for each possible fuel discount rate. It seems likely that more than 1GW would save us more money, even with our current transmission system, and I think that in the interest of an informed public discussion, the PUC should direct Xcel to come up with “least cost” alternative resource plans for fuel discount rates ranging between 2% and 6%, with real fuel price hedges built in to the fuel costs. I suspect that at low fuel discount rates it becomes advantageous to start investing in changing the nature of our transmission systems to allow the integration of more intermittent generation. The National Renewable Energy Lab just completed a study looking at the infrastructure implications of a nation-scale grid running on 80% renewable resources, and concluded it was technically and economically feasible to get there by 2050 using existing technologies. But that’s only going to happen if we start the transition now.

We can do this. We just need to make sure people are given the right incentives.

Xcel’s New Business Plan

If you’ve been paying attention here, you might be confused as to why Xcel isn’t already lobbying the hell out of the PUC to go for a plan like the one outlined above: huge renewable generation investments and a whole brand spanking new transmission system to support them. After all, Xcel only makes a profit on their capital expenses, and both renewable power and transmission infrastructure are all CapEx, all the time. Xcel doesn’t really care what the overall system cost is, or even what proportion of it is CapEx vs. O&M. The thing that most determines how much money they make is the absolute number of dollars they can pour into the capital investment pipeline. As rate-payers, we don’t care what the split is between CapEx and O&M either — all we see is the overall system cost. Given how much of the system cost is fuel today, it seems altogether possible that if we discount fuel appropriately and monetize future fuel price risks, then switching to a renewables heavy generation portfolio will both reduce overall system cost (satisfying rate-payers) and increase the number of dollars that go to CapEx (satisfying Xcel’s investors).

Furthermore, looking at the detailed costs in their baseline resource plan, it seems that we’ve elbowed most of the possible profit streams out of their Colorado operation. The contentious Clean Air Clean Jobs Act of 2010 (aka CACJ, compare opinions from Clean Energy Action, other climate campaigners, and Xcel itself) is allowing Xcel to make a bunch of capital investments (read: profits) retrofitting existing coal plants with modern emissions controls and building new gas-fired generation, in exchange for the early retirement of some of their older coal plants. But because there isn’t much projected need for new generation in the near term, once those projects have run their course the company’s capital investment pipeline starts to look a little grim.

Xcel apparently does not foresee itself building any of the renewable generation resources required by the Colorado renewable portfolio standard (or RPS, which requires 30% of our energy to come from renewable sources by 2020). Instead, their plan seems to be to buy all of that power via power purchase agreements (PPAs) from other wind and solar developers. This means that instead of Xcel getting to put those resources under their capital expenses (which they earn a markup on) they show up as “energy costs” under variable O&M (i.e. O&M costs that scale with the amount of energy you produce, or in this case, buy). Why would they do this?

Partly, this follows from the fact that the threshold size at which a new project must be competitively bid is very small for renewables, only 30MW. The wind and solar industries have become extremely competitive in recent years, driving down costs just like competition is supposed to, and it seems that Xcel has decided it just can’t compete with dedicated renewable developers. They’ve also been having a hard time competing with independent power producers (IPPs). The 569MW Cherokee 5 gas plant was exempted from competitive bidding under CACJ, which annoyed the IPPs to no end, as did the company’s exemption from the competitive process for the 750MW Comanche 3 coal plant outside Pueblo, CO.

In a few years the company won’t have any more of its own resources that need emissions control retrofits. They apparently don’t believe they can win the competitive bidding processes for either renewables or fuel based power plants, so without further bid waivers from the PUC (which are not in the best interests of rate payers) new generation is out as a CapEx/profit stream. Given this situation, it’s not surprising that they’re fighting tooth-and-nail for bid waivers and for the right to retrofit coal plants that might be better retired.

All this flows from a belief on the part of Xcel, the PUC, and a huge swath of the public that renewable power is intrinsically more expensive than fuel based power. The PUC is supposed to act on the behalf of the utility’s customers. Usually that’s construed as ensuring they have low cost electricity. Thus, so long as they think renewable energy is expensive, they can’t tell the utility to go build gigawatts of it, at least, not without a mandate like Colorado’s 30% RPS. If that changes; if the least cost option really is getting a lot of renewables online quickly — then they’re absolutely empowered to push for it. If they do, we’ll quickly discover there’s another capital investment that we need: a modern transmission system that can balance a large portfolio of geographically dispersed intermittent wind and solar generation with dispatchable firming resources like gas and, eventually, utility scale electrical storage.

Transmission is a much more of a natural monopoly than generation. It’s more like the road network, closer to being a public good. We only need one grid, to be shared amongst many different producers and consumers of power. And to do effective demand side management, distributed generation, and load balancing with lots of intermittent generation online, it’s got to look different from the system we have today. If renewable power is actually cheap, then Xcel — and every other investor owned utility in the country — should start developing plans and the expertise required to upgrade the grid. We get clean energy with known up-front costs, and the monopoly utilities get a viable business model for at least the next few decades.

Don’t hate the player, hate the game.

A lot of people hate Xcel, and see them as an obstacle on the path to a clean energy future. This is especially true in Boulder, after their nasty 2B/2C campaign last fall. I think mostly they’re responding in a rational way to a set of bad incentives we’ve given them, and acting to protect and create shareholder value, which they are legally obliged to do as a publicly traded company. Coal companies are irredeemable. Their core business is xenoforming the homeworld. They must be bankrupted, and quickly. Utility companies in general should come on board with the right incentives, if they don’t have too much sunk capital dedicated to burning coal. Even then, we have the option of letting them write off those sunk costs, since we are partly to blame for the messed up incentive structure that led to those investments.

Unless you’re willing to break away from them entirely, as Boulder is considering, just telling the utilities you don’t like what they’re doing isn’t enough. Just telling them what you’d rather they did isn’t enough either, even if you do it through a legally binding regulatory process like a renewable portfolio standard, or competitive bidding rules. Corporations can only become allies in this effort if we give them a profitable way to do what we want. If we tell them what to do without making it profitable, they will fight for loopholes and exemptions. They will lobby, campaign, and sometimes cheat outright. All markets are designed, and they can be designed well. We need to design our energy markets for the outcomes we want: reliability, cost-effectiveness… and the continued habitability of the Earth.

Resources

Some further reading, if you’re interested in this esoterica…

- Practicing Risk-Aware Electricity Regulation, by Ron Binz, former chair of the Colorado PUC (2012). Mainly deals with the issue of monetizing future fuel price risks in current cost assessments, and comparing the risk/cost profiles of various generation alternatives. Also discusses the biases which are currently baked in to the regulatory process, and the danger of allowing those biases to persist into the 21st century, as we embark on a $2 trillion utility CapEx build cycle.

- Discounting Future Fuel Costs at a Social Discount Rate, California Energy Commission Staff Paper (2008). The CEC staff explore the use of a social discount rate (3% real) to account for risk in future natural gas prices. They don’t appear to be discussing the different spending vs. time profiles that CapEx and fuel/O&M have… i.e. the fact that you don’t pay for fuel until you actually use it, whereas the CapEx is up front, and needs to be financed. Why is this?

Many thoughtful regulators (including Ron Binz and the staff of the California Energy Commission, referenced above) seem to agree on the necessity of pricing in future fuel cost risks. There’s some debate as to whether it makes sense to do that via a “certainty equivalent” such as the cost of a fully hedged future fuel supply, or via a so-called “risk adjusted discount rate” of the type apparently used in decision analysis (as opposed to finance theory), and advocated for by Shimon Auerbach.

I’ve heard much more criticism of the idea that future fuel costs should not be subject to the same discount rate as CapEx, because the costs are guaranteed by rate-payers and the capital outlay is deferred until close to the time of fuel consumption. Mostly, this idea seems to just piss finance people off, and unfortunately it’s been hard to get any cool-headed explanation of why this would be so wrong. Here’s what some of that criticism looks like.

As I noted above, because the PUC allows the monopoly utility to recover its operating expenses there’s never any net cash flow to discount, except in the case of capital recovery, which is at a fixed rate of return, also determined by the PUC. The spark spread and dark spread don’t apply here, because this is not a competitive market. It’s a monopoly. Were we talking about an independent merchant generator, then this would absolutely make sense. Unfortunately, if Xcel’s generation costs end up being much higher than the merchant fleet, it doesn’t matter — they still get to recover their costs. This is why exempting them from competitive bidding on their 569MW Arapahoe 5 gas plant and the 500MW of coal fired generation they own at Comanche 3 near Pueblo, CO was a bad idea. Had those processes been competitive, there’s every reason to believe that some independent power producer would have won the contracts, Xcel would not have gotten to add those capital investments into their rate base, and the rate payers would not be exposed to the full extent of future fuel cost risks associated with that generating capacity.

The question of the short-term financing that must be used to manage cash flows on an ongoing basis is much more interesting. Given that Xcel signs contracts to buy fuel up to several years ahead of delivery, and customers don’t pay their bills until some time after the fuel has been burned, there’s going to have to be some financing mechanism used in the meantime. Holding on to cash from earnings to finance fuel purchases would be very expensive — that would be equity financing. Short-term debt will be much more economical, and the rate on that short term debt will be closely tied to Xcel’s WACC. So, questions:

If short-term operational financing costs are incorporated into the delivered fuel cost estimates as represented in the resource plan, why wouldn’t it still make sense to discount them at the public’s social discount rate? The resource planning process is meant to provide a menu of different generation options to the consumers who — via their proxy, the PUC — choose which one they want to buy from the monopoly utility. Whether you look at the costs from the utility’s point of view or the consumer’s point of view can make a difference. If there are benefits to deferring payment for energy (by using future fuels instead of present capital spending that has to be financed) and those benefits accrue to the public in the sense that we don’t have to pay for the energy until later, then the discount rate of interest should be the public’s. With fuel, it’s our money that’s not being spent until later. With capital intensive renewables, it’s somebody’s capital that’s being used up front to create the generation resource, and we have to pay a return on that, in exchange for avoiding future fuel costs.

Regardless of the way the accounting is being done, there’s a trade-off here. We can spend a lot of money now to build generation that has little in the way of operational costs later, and we have to pay for access to the money with which we do the building — by paying back more than the cost of constructing the resource over the course of its useful lifetime. This makes sense (financially) if and only if the cost of financing the construction today is less than the cost of buying the fuel later. The cost of financing the construction today is going to be the cost of capital of whoever is actually building the resource — it could be Xcel, or more likely an IPP. Yes, the PPA is going to come through in Xcel’s books as an operational cost, but that doesn’t change the nature of the underlying investment — it’s capital intensive, and a lot of what we’re ultimately paying for is the financing, the spreading out of the cost over many years.

But with the future fuel savings, we do not have to pay for that service, at least not to the same extent. We are not buying several decades worth of fuel up front. We’re borrowing a little bit of money, buying some fuel, burning it, and recovering the cost, over and over and over again. Instead of paying for the privilege of paying later, we really are paying later, because we don’t need the fuel until later. Xcel is acting as our intermediary in this transaction, and passing the fuel costs through to us. Any benefit that’s to be realized by the deferring of those fuel costs is realized by us, not Xcel.

What I’m saying here ultimately is that the cost-benefits are asymmetric. If we want to do something capital intensive, we rely on the capital markets, and we have to pay the returns that they demand (the WACC). The time-value of actually deferring our energy spending, on the other hand, isn’t tied to the capital markets. It depends on our intrinsic valuation of future costs. These two ways of trading off between present and future energy spending need not have the same discount rate, and any reasonable public’s valuation of the future discounts it less than the capital markets.

There’s another interesting wrinkle to point out here, in the context of Boulder’s bid to form a municipal green utility. The city has a AAA credit rating, and its bonds are tax exempt, meaning it can offer a lower return to investors than Xcel (with their taxable BBB bonds). In 2011 the city issued utility backed municipal bonds for the water and sewer utility, and got interest rates between 2% and 4%. I have been told (and I would like to find a reference for this) that he capital improvement bonds that we approved last fall in ballot measure 2A were financed mostly at 2.5%, with a smaller fraction going for 0.9%. If the city’s cost of capital for the electrical utility were to look anything like any of those rates (and probably the top end of them is the only number that makes sense, being utility backed, long term, non-general obligation debt) then even without any other considerations, we’d end up making much less fuel intensive investments than Xcel, with their 7.609% discount rate.

There really is a difference in when money has to be spent to provision electricity with fuel based vs. renewable power options. We can pay financiers for access to their capital, and spread the renewable power costs out over a long period of time, and if we do so, we must pay the rates they demand, which imply an associated discount rate. Fuel-based options naturally defer some of their generation costs, and our choice of discount rate indicates our valuation of that deferral. If we choose a high discount rate, it means we value the deferral highly. A low discount means it isn’t worth very much to us. And in this actual deferral of income-based spending — not a financial transaction that allows us to defer spending at a price — what discount rate is appropriate, if not our intrinsic time preference?

And there’s a fundamental difference between the discounting that the utility company does to calculate their revenue requirements — the amount they need to get paid when, in order to make their allowed return — and the discount rate that we the consumers (via the PUC) should be using to present-value those spending curves, in our evaluation of the relative costs of the different plans, accounting for the time-value of money. One falls out of the company’s capital structure, the other is a public policy debate.