In May of 2013 I gave a talk at Clean Energy Action’s Global Warming Solutions Speaker Series in Boulder, on how we might structure a carbon pricing scheme in Colorado. You can also download a PDF of the slides and watch an edited version of that presentation via YouTube:

What follows is a more structured written exploration of the same ideas.

Policy Overview

Putting a price on carbon has become a panacea for climate change in the minds of some, and is seen as necessary if not sufficient to many others. In reviewing some of the literature on carbon pricing, and taxes in particular, I can see many ways that carbon pricing can be a powerful tool in the fight against climate change. However, at the same time done wrong I think you can price carbon without having much effect, and I think it’s possible to do a lot to reduce emissions without pricing them. That said, here’s an outline of a suggested policy:

- A modest carbon tax ($5 to $25/ton of CO2) should be levied. The tax must include the fossil fuels used in electricity generation. Ideally it would also cover transportation fuels (gasoline and diesel), as well as natural gas used outside the power sector, but those are less important.

- Electricity generation must be included because coal is the only fuel which has a high enough carbon content per unit cost to be significantly impacted by a politically plausible carbon tax rate.

- With the exception of making coal uncompetitive, the price signal will be too small to effect significant economic re-organization in systems dependent on other fossil fuels. Spending the revenues on mitigation strategies will be far more effective.

- With the exception of its impacts on coal, a low carbon tax is primarily a revenue source rather than a policy lever in its own right.

- In order for the generation mix to change as a result of the carbon tax alone, new generation must be allowed to compete with the operation of existing facilities, and fuel costs must not be blindly passed through to consumers without either rigorous regulatory oversight, or risk-sharing with the utility.

- Because fuel is only a modest portion of the electricity bill overall, rate payers will be much less aware of the carbon tax’s effects than the people making fuel buying decisions. Each $1/ton raises coal prices 5%, but electricity prices only 1%.

- Carbon tax revenues should be spent to the greatest extent possible on emissions mitigation, because at low tax rates energy demand is fairly inelastic, and so the mitigation that the tax revenues can buy is likely to be greater than the reduction in energy demand resulting from the Pigovian tax.

- Carbon tax revenues should support energy efficiency and renewable generation in extremely predictable ways leveraging public funds to mobilize private financing. Our goal should be to make these investments behave more like fixed-income securities and less like equities, with minimal volatility in their returns, to improve their access to capital, and reduce capital costs.

- Energy efficiency should be funded in the form of low-interest financing for deep energy retrofits on existing buildings, as well as financing of marginal efficiency measures above and beyond building code in new construction. Commercial and industrial EE programs should be similarly supported, using the public capital as a loan loss reserve, or via another leveraged funding mechanism, in order to stimulate the deployment of private funds.

- The local employment and economic development benefits of deep energy retrofits and more efficient new construction should be substantial. They should be tracked rigorously and publicized well.

- Renewable energy should be funded via a Feed-in-Tariff, offering a modest, performance based fixed-income like return on capital invested.

- Even with a carbon tax in place providing funding EE and RE deployment, there are still many market failures and other sources of policy drag that need to be addressed to make sure we get the most out of the program.

- A carbon tax is entirely compatible with a cap and trade scheme. The tax sets a floor on the price of carbon, while a capped emissions trading system sets a ceiling on the amount of emissions permitted.

- In the long run, carbon pricing should be transitioned from being a revenue source to being a policy lever, with a higher price on carbon applied uniformly across the economy. At this end of the spectrum life-cycle analysis based carbon footprinting at the point of consumption becomes important, to avoid offshoring of embodied emissions. This is a much more complex and legally challenging issue to address than local direct emissions.

Market Failures and Policy Drag

Many estimates have pointed out that there is an enormous amount of emissions mitigation available today at negative carbon costs — that is, they already save money, sometimes a lot of money. Amory Lovins and the Rocky Mountain Institute have been making this point for decades, most recently in their Reinventing Fire initiative. Business consulting giant McKinsey has chimed in as well, producing a series of GHG abatement cost curves for various nations, corporations, and the global economy as a whole. They tend to look something like this:

You can quibble with the details of these cost assessments, but most people who go through this exercise seem to find a large variety and a large quantity of emissions that can be avoided for cheaper than free.

How can this possibly be the case if we live in a free market utopia?!?

Markets are imperfect, and people are irrational. For every single little slice on the left side of that bar chart, there’s a local building code that needs to be changed, a split incentive that needs to be addressed, a consumer opinion that needs to be shifted, a trade association that needs to be educated, financing that’s unavailable, or some other friction in the existing system that prevents the economically sensible thing from being done.

Pricing carbon will shift the break even line upward on the graph, without addressing any of that friction. There are thousands of policy changes that need to be made in order for these profitable mitigation opportunities to be taken advantage of. If you move the line upward enough — say, $100 to $500 per ton of CO2 — then you can flip a lot of these economic incentives even without addressing the friction… but nobody’s really putting that kind of carbon tax on the table, and even if they were, failing to address the friction makes the whole endeavor more expensive than it needs to be.

Are carbon prices correlated with emissions?

As of yet, there doesn’t seem to be an obvious correlation between a jurisdiction’s carbon price and its per-capita emissions, or the change in its emissions over the last couple of decades. This shouldn’t be taken as evidence that carbon taxes don’t work. Rather, it points out that we still don’t have enough experience with carbon pricing mechanisms to know how they work. What we have is a lack of evidence. It’s very difficult to disentangle the effects of carbon pricing from all the other things that affect a jurisdiction’s emissions. There’s every theoretical reason to think that carbon pricing will reduce emissions, but the empirical details of how it happens in practice are still poorly understood. As NREL’s 2010 review of carbon taxation policies worldwide (PDF) pointed out:

One of the most rudimentary metrics for measuring carbon tax effectiveness is overall reductions in GHG emissions that can be tracked using GHG emissions inventories at the national or local level. This metric is flawed in that it captures not only the carbon tax effects but also the effects of other carbon mitigation polices and exogenous variables such as the level of economic growth.

In an ideal world, we’d be able to model the effects of the tax in isolation, but without controlled experiments, nobody seems to give these numbers much credence. Governments often model expected effects in advance of policies (for political purposes), but NREL notes that most retrospective evaluations of carbon tax policies haven’t even attempted to do confirm or deny those projections:

Examining the effects of a carbon tax alone on GHG emissions would provide a more precise estimation of policy effectiveness. Many governments model the effects of a carbon tax acting alone during the implementation phase of the tax. […] However, determining the actual impact of a tax in isolation of other factors is often difficult, and most evaluations have not attempted to do so. Because of the lack of common evaluation practices, it is difficult to compare the effects of policies across jurisdictions.

In January the OECD published a study on the effects of taxing energy use more broadly (reviewed here by the Washington Post). Their data shows that energy use per unit GDP is somewhat negatively correlated with energy tax rates, but there are big exceptions in that scatter plot. For example, Mexico and Sweden have the same emissions per unit GDP, but Sweden taxes energy at more than 25 times the rate of Mexico. And of course, average overall energy taxes aren’t the same thing as carbon taxes. You can have the same effective tax rate with very different economic makeups. You might also tax different parts of the economy differently, discriminating between different fuels (the EU taxes petroleum much more highly than other fuels) or by market segment (most countries tax industrial and commercial energy use much less than residential, since industry is often willing to re-locate to avoid the taxes).

Again, there’s every reason to think that in an ideal, frictionless world, pricing carbon would have the desired and predicted effect of reducing emissions, but we don’t live in that ideal world, and we don’t yet fully understand how carbon prices propagate through our complex economies.

Fuel Price Sensitivities

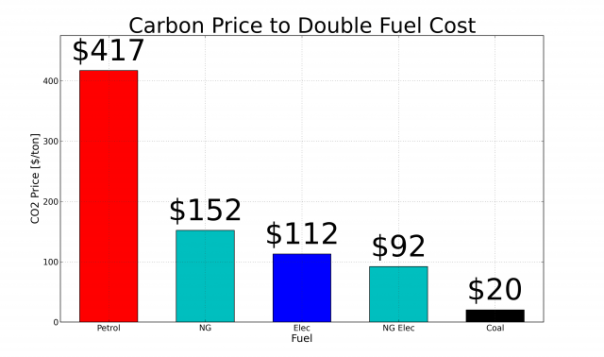

Looking at the carbon intensity of some fuels along with their prices can help give you a sense of what the price signals resulting from a price no carbon would feel like:

A tax of $1/ton of CO2 is equivalent to:

- About a penny per gallon, or a 0.3% price hike with $3/gallon gas.

- About 5 cents per thousand cubic feet (mcf) of natural gas. With residential and commercial natural gas rates running about $8.25/mcf, that’s a 0.66% increase.

- About a tenth of a cent per kWh of electricity on a coal dominated system like the one we have in Colorado. This is roughly a 0.87% price increase, since we currently pay about $0.09/kWh.

Of course, electricity isn’t really a fuel — there are lots of capital and non-fuel operational costs rolled up into electricity prices. Those other non-fuel costs mean that electricity prices will be significantly less sensitive to a carbon tax than the fuels that go into generating the electricity, namely coal and natural gas. In this context each $1/ton of carbon price means:

- Still about 5 cents per thousand cubic feet of natural gas, but electricity generators pay much less for their gas than we do: about $5/mcf today, which makes this a price increase of about 1%.

- About $0.093/MBTU of coal, which is about a 5.3% price hike on top of the fuel’s $1.75/MBTU delivered cost in Colorado (as reported by the US EIA).

So all these sources of energy are not equally sensitive to carbon pricing. This might seem obvious, given that they have different amounts of carbon per unit energy. However, their sensitivity to carbon pricing depends not on their carbon content per unit energy, but rather on their carbon content per unit cost.

Residential electricity in Colorado is roughly half again as sensitive to carbon pricing as residential natural gas, and nearly three times as sensitive as gasoline. Coal on the other hand is about 5 times as sensitive as natural gas in the context of electricity generation. Another way to say this kind of thing is that gasoline is expensive relative to its carbon content, and coal is cheap relative to its carbon content.

And this of course is the magic of pricing carbon versus simply taxing energy: it changes the relative attractiveness of different energy sources, which can stimulate a change in the mix of energy, while general energy taxes are better at inducing overall improvements in energy efficiency.

Using the price sensitivities above, we can explore the impacts of a carbon tax on energy prices, and see how those changes compare to the fluctuations in energy prices that we already experience, and our response to those fluctuations. For the sake of argument, let’s consider a carbon price of $25/ton, which is in line with what British Columbia and many EU nations have adopted.

Gasoline: $25/ton would mean about a $0.25/gallon increase in gas prices. For comparison, the Colorado state gas tax is $0.22/gallon, and the federal gas tax is $0.184/gallon, for a total of $0.404/gallon. Over the last 10 years, weekly average gas prices have varied between $1.37 and $4.03/gallon in Colorado, a range of $2.66 — that increase in price is equivalent to a $266/ton carbon tax. Despite that enormous price signal, our driving habits and the fuel economy of our vehicles have changed only modestly — VMT per capita has flattened out and started to decline rather than continuing to increase, but there doesn’t appear to be much historical correlation between fuel prices and VMT. Vehicle fuel economy has improved, but only to the extent that has been required by law. This suggests that an additional $0.25/gallon from a carbon tax would not have a dramatic impact on fuel consumption. This is largely a consequence of our land use patterns — in many parts of Colorado, driving is functionally mandatory, with little in the way of alternatives, even if one wanted to drive less.

Natural Gas: Space heating and domestic hot water both rely primarily on natural gas in Colorado. In those applications (as opposed to industry or electricity generation) annual average prices ranged from $5.62/mcf to $10.45/mcf between 2002 and 2012 (a $4.83 range). Last year’s price was $8.26/mcf. A $25/ton tax on CO2 emissions translates into a $1.35/mcf increase in price, which is about 16% of the current price, and just a bit more than a quarter of the total natural gas price variability we’ve experienced over the last decade. Looking at Colorado natural gas consumption data from the EIA, there’s no clear correlation with price.

Electricity: Based on EIA statistics, Colorado’s electricity supply emits on average about 0.8 tons of CO2 for each MWh generated, and on average across all sectors we pay about $90/MWh ($0.09/kWh). Charging $25/ton of CO2 emitted with our current generation mix would thus result in an increase in price of $20/MWh, or 22%, to about $110/MWh retail, which is still cheaper than the entire Northeast, California, and many other states, but a little higher than the US average of $96.50/MWh. Nationwide, per capita electricity consumption is well correlated with the retail prices. Despite its low electricity prices, Colorado is relatively efficient, using about 10 MWh/person annually, significantly less than the national average of 12MWh. If our response to the increase in electricity prices was consistent with the general price-consumption relationship nationwide, the additional $20/MWh might eventually be expected to take our consumption down to the levels seen in New York, California, New Jersey, and the other most energy efficient states, but it’s not clear how much of the difference in electricity consumption is due to the price elasticity of demand, and how much of it has to do with the most expensive electricity also being in states that have strong energy efficiency policies.

Of course, fossil fuel based electricity is really coming from two different sources: natural gas and coal.

Natural Gas for Electricity: Utilities buy natural gas at a steep discount from the retail consumer rates, currently around $5/mcf, but that price has bounced around between $2.50 and $7.50/mcf (annually averaged) over the last decade. Our hypothetical $25/ton CO2 price would again add $1.35/mcf, or 27% to the cost of gas for electricity generation, which is significant, but still well within the range of price volatility that gas has experienced recently.

Coal: Unsurprisingly, coal feels the impact of a carbon tax far more than any other fuel. Coal costs in Colorado are around $1.75/MBTU, and each MBTU puts out about 0.093 tons of CO2, so each $1/ton of CO2 increases the cost by about 5.3%. This means that our heretofore modest $25/ton tax more than doubles the price of coal in Colorado, taking it from $1.75 to just over $4/MBTU. This is well beyond any coal price that we’ve ever paid in Colorado, and comparable to some of the most expensive delivered coal prices anywhere in the US. That’s the kind of price you pay if you put Wyoming coal on a train and take it to Georgia to burn.

So, with the notable exception of coal, the price signals that would result from charging $25/ton of CO2 emissions are smaller than the price fluctuations that we already deal with, either from state to state or as market prices change over time. I think this is both encouraging and discouraging. It’s encouraging because it means we could probably implement an economy-wide carbon tax without being any more disruptive to the economy than existing market fluctuations, which seems like it ought to make the tax more politically palatable. It’s discouraging because the whole point of a carbon tax is to be disruptive! Not disruptive in the sense of rolling blackouts and mile long lines for gasoline, but rather in the sense of spurring a major re-organization of the economy around low and zero carbon energy sources, and vastly more efficient utilization of that energy.

Revenue Source vs. Policy Lever

The idea of pricing carbon to get economic actors to internalize its social costs is elegant, and attractive given that most of the world has ended up with a strong pro-market ideology. Unfortunately as I noted above, there are numerous market failures that prevent us from taking advantage of already sensible energy efficiency opportunities. Additionally, we have a general policy of heavily discounting future costs and giving preference to present day consumption instead. This results in low estimates for the real cost of carbon — often the order of the $25/ton that I used above. The economic impacts of that kind of carbon price are modest (unless we’re talking about coal), which makes them more politically plausible, and less effective in stimulating the required steep decline in our greenhouse gas emissions.

Thankfully there’s another way to look at all this. Rather than treating the carbon price as a policy lever, we can think of it as a revenue source that funds emissions mitigation. This approach has several advantages.

- It’s much easier to measure the emissions consequences and cost effectiveness of mitigation programs.

- If the price elasticity of demand for a given fuel is low, a small carbon tax will have much less impact on emissions than the mitigation measures the revenues can fund.

- When viewed as a funding mechanism, it’s less important that the carbon tax be applied uniformly across different economic sectors and fuels, which allows more political flexibility in its application.

- The emissions mitigation that results from funding EE/RE policies directly is much less dependent on addressing the market failures that keep people from taking advantage of existing opportunities.

To explore what that picture looks like, we need to know roughly how much money a given carbon tax would raise, how much it would reduce the demand for energy, and how much emissions mitigation could be funded with it.

For example, say natural gas and coal burned to generate electricity were taxed at $25/ton of CO2 emitted. Together, they emit about 40 million tons of CO2 a year in Colorado, so at current rates of usage, this tax would raise $1 billion. The most cost effective emissions mitigation is still energy efficiency. Seattle City Light just initiated a Pay for Performance energy efficiency program, offering $30/MWh saved. If we take that as the cost of efficiency, then $1 billion could buy 33 TWh worth of energy savings. Conveniently, 33 TWh is roughly the amount of electricity we generate from coal each year in Colorado, so given these assumptions, we’d be able to displace all our coal with efficiency! Except, obviously at some point the cheap efficiency opportunities are all used up, and you have to go for more costly improvements, and probably that happens before you’ve reduced electricity use by a factor of 3… Also, the nature of a carbon tax (and all Pigovian taxes) is that as the tax takes effect, there’s less and less of a tax base — as energy demand declines due to the efficiency improvements, we would have to raise the carbon tax rate to maintain the same level of revenues.

Another example: say instead of choosing to fund efficiency, we decided to build wind farms. Without the production tax credit (PTC) new wind in good sites is coming in at around $60/MWh (the PTC is worth about $22/MWh, so with it, new wind would be more like $38/MWh). Spending the same $1 billion in carbon tax revenues on wind would get us about 17 TWh of wind energy per year, which at a 33% capacity factor is equivalent to nearly 6 GW of installed capacity, capable of displacing roughly half of the 35 TWh of coal fired electricity we use each year.

Both of these examples are obviously naïve, but they suggest that $25/ton is at least the right order of magnitude to consider if we want to replace our existing coal fired generation with a mix of better energy efficiency and renewable power. All I mean by that is, looking at the average carbon price over the lifetime of the policy $5/ton probably won’t get it done, and $125/ton isn’t likely to be necessary, though we might start at $5/ton and work our way up to $125/ton as emissions are reduced over decades.

Another good reason to use carbon tax revenues for mitigation programs rather than as general tax revenue, or to create a climate dividend, is that by design the revenue source will eventually dry up. Paying carbon tax revenues into the general fund or out to the public creates a potentially powerful constituency that doesn’t want to see the revenues decline, and which may work to oppose emissions reductions. Conversely, the need to spend money on emissions mitigation programs declines along with emissions, and thus the carbon tax revenues.

Another benefit of treating a carbon tax primarily as a revenue source rather than a policy mechanism is that it becomes less important for all sectors of the economy to be taxed at equal rates. Different consumers have different demand elasticities. Sweden has the highest carbon tax in the EU at more than $100/ton, but that rate isn’t applied uniformly to everyone — industry pays only $23/ton. We can argue about whether or not that’s fair, but from a utilitarian standpoint, it’s reasonable. If the economic impacts of a carbon tax are great enough that it makes sense for a business to relocate to avoid it, there’s every reason to think that they will do so, in which case their emissions end up being unaffected by the tax — rather than paying into the mitigation fund, they will spend money on relocation expenses.

It’s also worth noting that many countries in the EU use their carbon taxes as general revenue sources, and they pay for emissions mitigation programs out of their general funds because they are a policy priority. Denmark dividends 60% of its carbon tax revenues, and uses 40% for mitigation programs. Finland and British Columbia both have revenue neutral carbon taxes that displace other tax revenues in the general government budget. All of these jurisdictions are willing to implement policies and spend general funds in order to reduce emissions. Linking carbon tax revenues to mitigation programs is elegant because the available revenues and the required spending generally scale with each other, but it’s not strictly necessary if emissions reductions are a high policy priority generally. Unfortunately, that’s not yet the case in the US.

It’s also worth looking at whether a revenue neutral tax displacing carbon price would really make much of a difference in the context of our overall tax structure. At the federal level, this proposition is questionable at best. The US emits about 7 billion of carbon each year, and all federal tax revenues add up to about $2.1 trillion ($2,100 billion). So, hypothetically, if we were to apply a carbon price to all of our emissions (politically unlikely, to say the least), and wanted to use it to displace all of our federal tax revenues… we’d have to charge $300/ton. Nobody’s really suggesting that, but people do talk about using a revenue neutral carbon tax to say, “fix” the federal deficit, which in 2013 was projected to be $650 billion. Again, with a uniform carbon price applied to all 7 billion tons of US emissions, that would mean charging about $90/ton — still a higher price than most policymakers are willing to moot in public. For the $900 billion in personal income taxes or payroll taxes, you’d have to charge $130/ton. For the $200 billion in corporate income taxes, it would be about $30/ton. So in the grand scheme of our federal tax policy “politically feasible” carbon prices appear to be of marginal utility at best. Especially given the large policy trade-offs that revenue neutrality requires — foregoing the possibility of investing directly in mitigation, and relying entirely on market mechanisms in broken markets — I think that going with a revenue neutral carbon pricing model represents an enormous concession, to be made only as a desperate last resort.

Furthermore, it’s very unclear to me that making this large concession actually buys much political support. Instead it seems more likely to be a clever ploy on the part of the right wing to shape our thinking on carbon pricing — if a carbon price is going to happen eventually (despite their objections), then they’d like to make sure that it’s the most innocuous carbon price possible. A regressive (income tax displacing) revenue neutral carbon price is extremely unlikely to disrupt business as usual, and so can likely be held up as an example of policy failure after its been in place for a while — but in the meantime it can reduce the tax burden on corporations and the rich. So hey, what’s for them not to like?

Cap-n-Trade vs. Carbon Tax, FiT vs. RPS

There’s been a lot of debate about whether carbon taxes or cap-and-trade schemes are the right way to go about pricing carbon. We don’t actually have to make a choice — the two schemes are not mutually exclusive. In fact, they compliment each other. A carbon tax essentially sets a price floor on emissions, while a cap and trade system places a cap on the overall emissions. Using them in tandem can help avoid some of the failings of the EU’s ETS, in which the cap is too high, and so the carbon price is so low as to be a poor economic incentive. In an ideal world, either system could be made to work, with the emissions cap ratcheted down over time in accordance with the emissions trajectory required to meet our climate goals, or the tax rate increased with the same aim. In practice either of those approaches is politically challenging. Financially, cap and trade schemes behave more like equity markets, with potentially large fluctuations and large profits for those who are able to reduce their emissions most aggressively, while a carbon tax is more analogous to the fixed-income (bond) markets — relatively stable prices and well understood returns. A similar analogy exists for feed in tariffs and renewable portfolio standards, with feed in tariffs behaving more like bonds from the investor’s point of view.

Given the long capital lifetimes of investments in both renewable generation and the most aggressive energy efficiency measures, and the desire for predictable policy outcomes over decades, it seems prudent to allocate a substantial fraction of our policy portfolio to the bond-like strategies. This is just a small piece of a much larger discussion about when it makes sense to trade efficiency for robustness. Highly optimized efficient solutions are usually brittle — they tend not to fare well in a wide variety of scenarios, even though they may do extremely well in the scenario they were designed for. Robust solutions are those that have acceptable performance in a wide variety of scenarios, and are desirable when the costs of failure are large and/or the environment that the solution must perform well in is poorly constrained. Climate change easily satisfies both of these criteria. This issue is discussed in the World Bank’s recent white paper: Investment Decision Making Under Deep Uncertainty.

Further Reading:

- Carbon Taxes: A Review of Experience and Policy Design Considerations from NREL.

- Global GHG abatement cost curves from McKinsey Consulting.

- A Policymaker’s Guide to Feed in Tariff Design from NREL.

- Cutting Carbon Costs: Learning From Germany’s Energy Saving Program, from the London School of Economics.

- Overcoming Market Barriers and Using Market Forces to Advance Energy Efficiency from the American Council for an Energy Efficient Economy